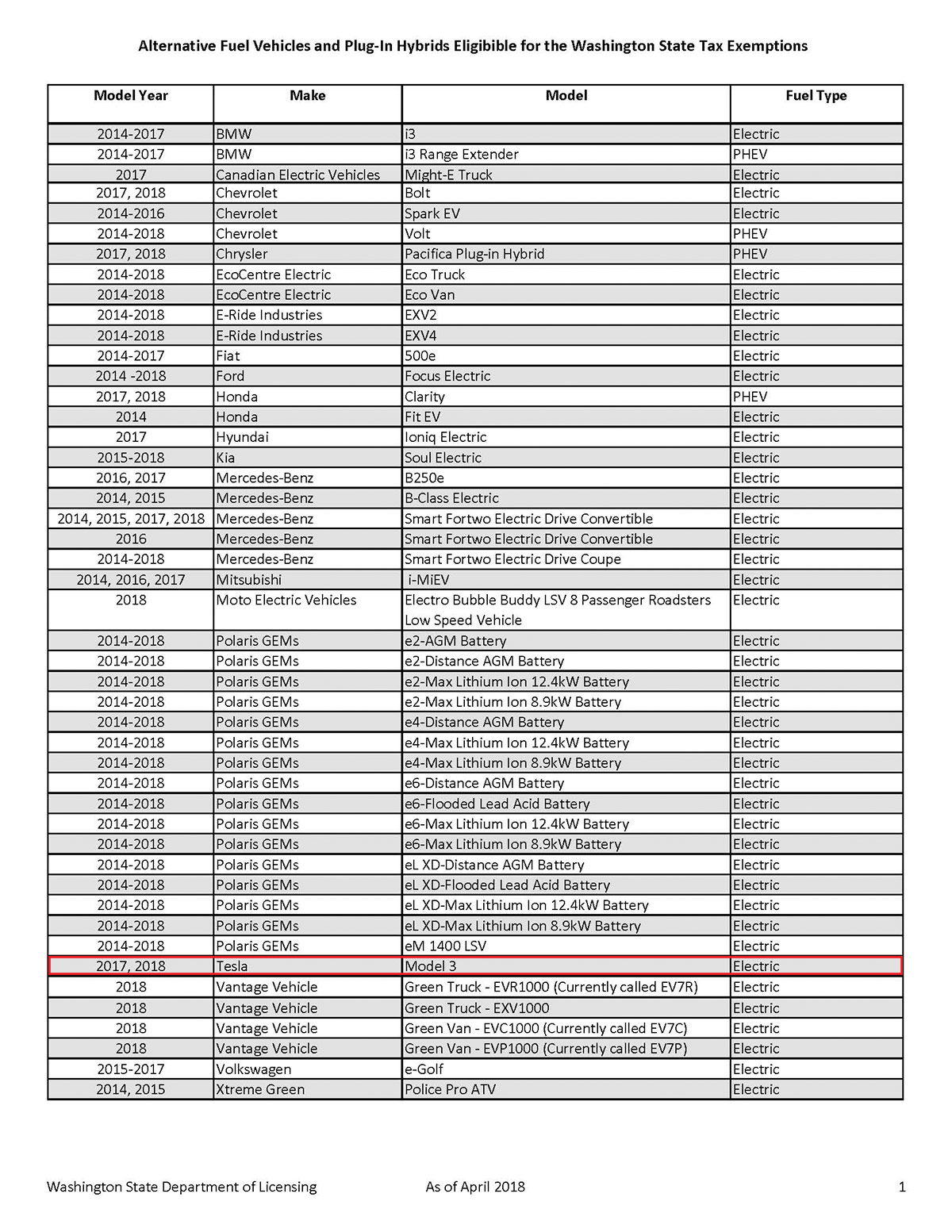

More Tesla Model 3 deliveries needed for Washington State as tax incentive ends May 31

Tesla might need to push Model 3 deliveries harder towards Washington state reservation holders as the incentive program will end May 31 i.e. almost 40 days remaining to apply for tax exemption.

Washington started the tax exemption program in July 2015 to boost adoption of clean alternative fuel, electric, and plug-in hybrid vehicles in the state.

The maximum number of vehicles set to be sold was 7,500 until the program will start to phase out — this target is achieved but still you can apply for tax exemption for a new vehicle purchase until May 31, 2018 if it meets the following criteria.

1. You purchased or leased:

- a new passenger car

- a light duty truck, or

- a medium duty passenger vehicle.

AND

2. The item you purchased or leased is:

- powered by clean alternative fuels; or

- is a plug-in hybrid capable of traveling at least 30 miles using only battery power; and

- is sold or valued at $35,000 or less (including the amount of any trade-in vehicle).

If you signed a lease on a qualified vehicle on or after July 15, 2015 and before July 1, 2016–and the fair market value of the vehicle was less than $35,000 at the beginning of the lease–you do not owe sales tax on your lease payments.

From July 1, 2016 through May 31, 2018:

You can use this exemption if all the following apply:

1. You purchase or lease one of the following vehicles that has a base model price less than $42,500 (DOL determines this model price):

- a new passenger car

- a light duty truck, or

- a medium duty passenger vehicle.

AND

2. The vehicle you purchase or lease is:

- powered by clean alternative fuels; or

- is a plug-in hybrid capable of traveling at least 30 miles using only battery power, and

- is listed on DOL’s qualifying vehicles list: http://www.dol.wa.gov/vehicleregistration/altfuelexemptions.html (list table below)

The exemption applies up to $32,000 of a vehicle’s:

- selling price; or

- total lease payments you’ve made, plus the purchase price of the leased vehicle.

Do I need to report this exemption?

- No, the dealer you purchase or lease the vehicle from must keep records to support the exemption.

For questions about the exemption, call Taxpayer Account Administration at 360-705-6214.

I have been talking to WA residents and they really hope Tesla to take action and cease this vanishing opportunity for their loyal and enthusiastic customers.

Production will begin at the Tesla Fremont factory after Saturday as the huge facility is in an upgrade process to kick 24/7 production schedule and increase Model 3 production exponentially.

We hope this goes smooth for Tesla but if some focus is put in shipping Model 3s to Washington for the next couple of weeks, customers can enjoy tax exemption and be thankful to Elon Musk/Tesla.

Hope the voice is heard and answered — good luck to WA reservation holders (raise your voice, share your thoughts in the comments section below).

No Comments